The Invisible Hand of the Market Milan Zelený

“ … every individual necessarily labors to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.”1

The basic problem with the “invisible hand of the market” is that it is a metaphor, not a concept or principle; only simpletons refer to it as such. In practice, it is still too invisible, so governments are tempted to make it more visible through political interventions.

What Adam Smith actually said was that an individual’s behavior and decision-making, insofar as it is driven by certain rules (for example, looking for profit to the satisfaction of customers), adds value to all the individuals who behave similarly—and in this way they all add value to society together. As Smith affirms, this chain-linked impact on society is not followed, perceived, or known by any single person in his own individual efforts—he does not even need to know it. The efforts of the individual are led, as if, by an invisible hand:

“It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own self-interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.”2

Smith’s interest was more ethical than economic: acting in one’s own interest is not necessarily bad or reprehensible from the moral point of view.

That is all Adam Smith said and knew about it. The hand of the market remained invisible even for him. The “invisible hand” then became the mantra of religiously fervid advocates of the free market who did not make suitable attempts to understand or explain it.

Smith could not go beyond the understanding of 18th‑century economics (which in England in 1776 was predominantly agricultural). He wanted to be understood only by his own readers. He laid aside the nontransparent metaphor of the invisible market, and is not to be blamed for it. The ones to be blamed are his naive interpreters, especially those who flourished in the Czech Republic after 1989. These “economists” confused the uninformed nation with slogans about how the invisible hand of the market would solve everything, how “dirty” money could not be identified (because 100 crowns is 100 crowns) and that thanks to coupon privatization the dicks (holders of coupons) would become coowners of Czech national wealth!

In his creative euphoria Smith forgot that the personal interest of the butcher is not necessarily ethical; he can mix sawdust or poisonous dyes into the sausage or, like the legendary Sweeney Todd, make money out of human flesh. One has to keep a sharp eye on the friendly butcher or greengrocer, inspect their projects and regulate their behavior.

The postcommunist “economists” did not understand it themselves; they turned a simple metaphor into a powerful myth which they raised to a basic principle of capitalism—even though in a politicized and, typically for the Czech environment, degraded form. In place of trust in “Party and government” they placed their trust in the “invisible hand of the market.” It was not common sense but blind “religion” that predominated in the economic thinking of the Czech geographical basin. That facilitated unprecedented state intervention into the economic transformation and unforeseen shifts of state property into the network of political influence, financial power, and criminal organizations.

Smith never affirmed that a person should behave in the sense of his personal interest, only that he does behave that way. He himself spoke up for cooperation and charity. He only once used the phrase “invisible hand,” in the sense of prices giving a signal: if there is a shortage of goods the price goes up, consumption goes down, and production goes up, and consequently the price goes down again, consumption goes up, and the original shortage is thus overcome. This obvious principle ceases to be self-regulatory in the course of massive interventions by the government into the economic sphere, of market prices being deformed, and of the increasing speed of decision making thanks to technological advances.

Much more interesting is the formulation of the problem of the division of knowledge according to von Hayek. While Smith’s division of labor has been repeatedly examined, Hayek’s division of knowledge was mostly overlooked by the science of economics (Václav Klaus affirms that he knows of no role for knowledge in economics). Friedrich von Hayek declares the problem of the division of knowledge as being the central issue of economics as a social science:

“Clearly there is here a problem of the division of knowledge, which is quite analogous to, and at least as important as, the problem of the division of labor. But, while the latter has been one of the main subjects of investigation ever since the beginning of our science, the former has been as completely neglected, although it seems to me to be the really central problem of economics as a social science. The problem which we pretend to solve is how the spontaneous interaction of a number of people, each possessing only bits of knowledge, brings about a state of affairs in which prices correspond to costs, etc., and which could be brought about by deliberate direction only by somebody who possessed the combined knowledge of all those individuals.”3

The old economy does not solve this central problem; issues of differentiation of data, information, and knowledge are still foreign to it. In place of specifications about how much knowledge participants must possess as a minimum in order to reach a state of equilibrium, old science presupposes that everyone knows everything. So it gets round solving the problem by ignoring it. Information about ordinary prices alone is not enough; just as necessary is knowledge of how and under what conditions to acquire and use the various resources and commodities.

The central question in all the social sciences can be similarly formulated: How can a combination of fragments of knowledge, existing in various minds, bring about results which would, if followed with a focus on goal and function, require an executive intellect with the knowledge that it is impossible for any individual to possess? These things—an omnipotent and all-knowing dictator, a supernatural “social mind,” a competent “Party and government,” or state economists with crystal balls—simply do not exist. For Hayek, the invisibility of the “invisible hand” remained the tragic failure of the science of economics.

In his last book, The Fatal Conceit, Hayek remembers how lonely he felt in his efforts to understand the evolution of self-organizing systems. It was not until 1988 that he recognized how numerous these new studies were: “This insight was only the first of a growing family of theories that account for the formation of complex structures … under various names such as autopoiesis, cybernetics, homeostasis, spontaneous orders, self-organization, synergetics, systems theories, and so on.”4

Hayek also lamented the poor understanding of self-organization in traditional economics, which is based on machine-like rather than organic perception of economic processes:

“As primitive thinking usually does when first noticing some regular processes, the results of the spontaneous ordering of the market were interpreted as if some thinking being deliberately directed them, or as if the particular benefits or harm different persons derived from them were determined by deliberate acts of will, and could therefore be guided by moral rules. This conception of ‘social’ justice is thus a direct consequence of that anthropomorphism or personification by which naive thinking tries to account for all self-ordering processes.”5

Machines and mechanistic contrivances are indeed not self-producing. Friedrich Hayek even coined the term catallaxy to describe a “self-organizing system of voluntary cooperation,” in regard to capitalism.

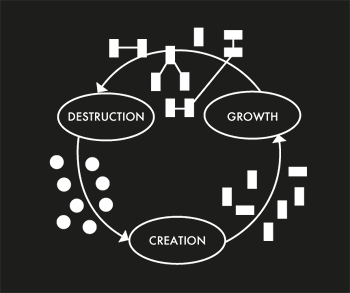

The principles of autopoiesis (self-production), outlined in the illustration here, are based on a study of collective biological and social phenomena. It is not reproduction and evolution that is of greatest importance to organisms, but their primary self-production. Organisms differ from machines in that they are not constructed externally by man (heteropoiesis), but develop internally, voluntarily, through autopoiesis. Similarly, the institution of the market and the whole sphere of economics behaves like a living organism, not like a dead machine.

But if we perceive the adaptable organism of economics as a machine (a heteropoietic miracle of human engineering), then it is not surprising that important self-driving and self-regulating qualities do remain invisible; it is as though the invisible hand of an invisible mechanic drove an invisible mechanism. Just as a mechanical rabbit differs from a real rabbit, so a mechanical concept of the economy necessarily differs from the real economics of a live organism. The system of biology, not an engineer’s physics and mathematics, is the basic instrument for recognizing the economics of the free market.

The whole of the animal world is marked by the phenomenon of the “invisible hand.” Ants, bees, and termites create structures which none of the individuals had “in mind,” could not plan, and were not led to by the visible hand of the queen. The complicated and functional structure of their heap, hive, or nest is the result of an action and only an action—not something thought up through a plan, motivation, or a superior “idea.”

An economic order issuing spontaneously from a sum of individual decisions is more effective and rational than a similar order construed by an intelligent and rational planning entity. That is why every attempt at central planning and directive management of economics fails. Mankind lacks the all-knowing intelligence which would enable the planners to determine the level of supply and demand in advance. If it seems to you that things are expensive now—wait until the government makes them “free.”

The invisible hand of the economic organism must therefore be explicated. That is why it is necessary to make the self-production of the market as visible as possible by understanding it, not by replacing it by planning and conniving State. That is why clumsy interventions—like badly trained Maschinenführers or “engineers of human souls”—into systems we do not understand have to be stopped. People understand only what they construct themselves: everything else remains an “invisible” mystery and it is not appropriate to play around with it childishly, whether in a Keynesian or Friedmanesque way. The crisis or illness of an organism is not like a machine breaking down; it cannot be cured by mechanical intervention. Human psychology, knowledge, and decision-making are more important than mathematical equations and shifting of gears.

Not only socialists and communists fail to understand that an effective social order originates through autopoiesis, spontaneously, as the outcome of freedom of choice and freedom of action; see the function of the autopoietic system in the illustration.

Creation (construction): new entrepreneurs create new enterprises.

Growth (of a network, construction): the enterprises grow, divide, and connect themselves into networks.

Destruction (deconstruction, termination): the networks, their parts, and individual enterprises collapse and go bankrupt, new entrepreneurs step into this eternal cycle.

The crisis or “creative destruction” or “inspired disaster” is thus a natural part of the capitalism of the free market. Without crises the old cannot be replaced by the new. Socialism banned crisis and unemployment by decree—self-renewal and regeneration came to an end, and the system choked itself, in its own waste.

The basic premise of the free market is that during each transaction both parties, selling and buying, must realize the added value. Otherwise they cannot enter into the market transaction freely, only on the basis of force, fraud, and misinformation, or threats, theft, stupidity, abuse, and lack of transparency … there is nothing free about this sort of “market.”

The regulation of the market is necessary for the protection and safeguarding of the freedom of both parties. Thus as civic freedom is not the freedom to shoot but more importantly the freedom not to be shot, so the freedom of the market is not the freedom to steal but the freedom not to be stolen from. That is why free markets must be protected.

The difference between the free market and the open market is critical. The “anything goes” open market enables unregulated intervention into market transactions by the State, by political parties, by monopolies and by associations of producers and consumers who follow their own profit only at the expense of another’s. Market intervention artificially (not respecting the market) favors one side or the other while market regulation assures natural (market) balance—that is, honesty, integrity, decency, and propriety on both sides.

The present worldwide crisis originated at the point of intersection of insufficient regulation and rampant intervention. The State failed twice: (1) it ceased to regulate the market behavior of those taking part in transactions, and thus left the invisible hand of the market to be too invisible (so that people harmed each other); (2) it intervened too much on one side or another, became itself the visible hand of the market, and did not control the complexity and deformation of the market economy.

The invisible hand of the market thus got a walloping twice over.

The problem is that the State cannot substitute for the market because the state is also people—small “nails” in a large coffin of lost dreams and plundered lives.

Note

1 / Adam Smith, The Wealth of Nations, W. Strahan and T. Cadell, London 1776, book IV, chapter II, paragraph IX.

2 / Ibid.

3 / Friedrich A. Hayek, “Economics and Knowledge,” presidential address delivered before the London Economic Club on November 10, 1936. Reprinted from Economica IV (new ser., 1937), p. 33–54.

4 / Friedrich A. Hayek, The Fatal Conceit, The Errors of Socialism, ed. W. W. Bartley III, University of Chicago Press, Chicago 1988, p. 9.

5 / Hayek, The Fatal Conceit, p. 146.